Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Should I rent or buy after retirement?

If you’re like many of our clients, you’ve decided your current home won’t fit your needs for long after retirement, but the great debate is holding you back: should I rent or buy my next home?

Ask yourself these four questions to end the debate and start a plan to move forward.

1. Is it time for flexibility or solid roots in your life?

For some, renting and the minimal commitment that comes with it is a perfect fit to their new lifestyle. It allows for you to test drive a new neighborhood, housing style or a more nomadic lifestyle.

For others, home is the figurative (as well as literal) foundation to their lives and remaining homeowners is a source of stability to their day-to-day lives. Owning removes the relationship with a landlord and their role in your life, which for some is very important.

2. How long do you intend to live in the new home?

Some people decide to Right-Size prior to retiring, whether it’s to take advantage of a strong housing market or to live in a more manageable space after the kids move out. An important consideration is how long you are planning to live in the home you move to, after selling the larger family home. If you are thinking you’ll retire in a year and then move out of the city for good, it might make more financial sense to rent for that year.

If you want to keep a residence in the city after retiring, even for part of the year, purchasing a smaller home or condo could be a great solution both financially and for peace of mind.

3. Freedom from your house or freedom from rules?

Freedom for renters comes in the form of not having to worry if it’s time to replace the roof or if the washing machine is acting up again. When you rent you are paying the landlord for the right to live in and enjoy the home. Part of that arrangement means the responsibility for maintenance falls to the landlord.

Freedom for owners comes in the form of having control over your space. When you rent you have to clear decorating choices with the landlord and you have little (if any) say in how a repair is carried out. Owning means you carry the cost to maintain the home, but also control over the decisions involved.

4. Do you want the equity now or later?

Selling your home and renting means you have the option to invest that freed up equity in other ways or create a plan to live off your nest egg.

If you buy another home, it’s more difficult to access that reinvested equity but as real estate is typically considered a safe long term investment, your capital is protected, and hopefully appreciating, while keeping a roof overhead.

Explore 5 Objections to Retirement Living

Explore 5 Objections to Retirement Living

Your aging parent is struggling at home. You think it might be time for them to consider a move to a retirement community, but you’re dreading having the conversation. Or maybe you’ve already broached the subject with them and gotten nowhere.

You’re not alone.

Every day we see families wrestling with these thorny discussions. Here are 5 common phrases used by seniors who are resistant to the idea of living in a retirement community. Maybe you’ve heard one or more of them already.

- “I’m not ready.” Perhaps your aging parent is willing to concede they might need to move sometime in the future, but that time is not now. They may minimize any problems they’re currently experiencing.

- “I don’t need to move. I get all the help I need right here.” A variation on the previous sticking point. They may take for granted support they’re getting from family, friends, or neighbors, not recognizing the stress it may be putting people under. Or they may assume their needs aren’t going to increase.

- “I don’t want to move to a home.” They equate retirement communities with nursing homes even though the two are completely different. They may have an outdated idea of retirement communities, perhaps based on experiences they had with their own aging parents.

- “It costs too much.” They may be intent on leaving money to their kids and/or grandkids and be averse to the idea of spending any of it on their own care. And they may overestimate the difference between the cost of living in their current home and moving to a retirement community.

- “I’m leaving my home feet first in a pine box.” They insist that they have absolutely no intention of leaving their current home. They flat out refuse to contemplate any other options.

It’s hard to overcome this type of resistance. While you may be focused on your parent’s safety, they may be worried that leaving their current home will mean giving up their independence. They don’t recognize that a move to a retirement community may actually increase their independence and quality of life by freeing them from mundane tasks and giving them more chances to make social connections and pursue various leisure interests.

Sometimes the best approach is to simply make the initial suggestion and wait for “teachable moments” to present themselves. Maybe your parent has a fall but avoids serious injury. A close call like this may open their eyes to the benefits of having people around in case something similar were to happen again. You might use this opening to suggest visiting some retirement communities “just to get a sense of what they’re like”.

It’s also a good idea to highlight the benefits of retirement communities rather than simply focusing on your parent’s need for care and support. Freedom from housework. Restaurant-style meals. More time to focus on what’s important to them.

That said, even if you do all this, you may still have a hard time getting past your parent’s objections. That’s when involving a trustworthy third-party can be helpful. Someone who knows local retirement communities inside and out and has experience helping families navigate these type of prickly discussions.

Should I Rent Or Buy After Retirement?

Should I Rent Or Buy After Retirement?

If you’re like many of my clients, you’ve decided your current home won’t fit your needs for long after retirement, but the great debate is holding you back: should I rent or buy my next home?

Ask yourself these four questions to end the debate and start a plan to move forward.

1. Is it time for flexibility or solid roots in your life?

For some, renting and the minimal commitment that comes with it is a perfect fit to their new lifestyle. It allows for you to test drive a new neighborhood, housing style or a more nomadic lifestyle.

For others, home is the figurative (as well as literal) foundation to their lives and remaining homeowners is a source of stability to their day-to-day lives. Owning removes the relationship with a landlord and their role in your life, which for some is very important.

2. How long do you intend to live in the new home?

Some people decide to Right-Size prior to retiring, whether it’s to take advantage of a strong housing market or to live in a more manageable space after the kids move out. An important consideration is how long you are planning to live in the home you move to, after selling the larger family home. If you are thinking you’ll retire in a year and then move out of the city for good, it might make more financial sense to rent for that year.

If you want to keep a residence in the city after retiring, even for part of the year, purchasing a smaller home or condo could be a great solution both financially and for peace of mind.

3. Freedom from your house or freedom from rules?

Freedom for renters comes in the form of not having to worry if it’s time to replace the roof or if the washing machine is acting up again. When you rent you are paying the landlord for the right to live in and enjoy the home. Part of that arrangement means the responsibility for maintenance falls to the landlord.

Freedom for owners comes in the form of having control over your space. When you rent you have to clear decorating choices with the landlord and you have little (if any) say in how a repair is carried out. Owning means you carry the cost to maintain the home, but also control over the decisions involved.

4. Do you want the equity now or later?

Selling your home and renting means you have the option to invest that freed up equity in other ways or create a plan to live off your nest egg.

If you buy another home, it’s more difficult to access that reinvested equity but as real estate is typically considered a safe long term investment, your capital is protected, and hopefully appreciating, while keeping a roof overhead.

4 Considerations for Aging In Place

4 Considerations for Aging In Place

Sometimes RightSizing can mean staying in your own home by making modifications. If you aren’t sure where to start, here are four areas to think about if Aging In Place is an option.

1: Small changes, big impact

There are numerous modifications that can make a world of difference when it comes to how you interact with your home. Grab bars in bathrooms are a common solution, but think about other places where one might come in handy like the top of a set of stairs. Other hardware upgrades include changing your doorknobs to a lever style, installing pull out drawers in you lower kitchen cupboards, and floor lighting to automatically make getting around at night safer.

2: Same home, different function

If your mobility is affecting your enjoyment of your home, there might be options to reduce the number of stairs you need to face on a daily basis. Outside, ramps and lifts are a possible solution. Inside, beyond installing a stairlift or elevator, look at you main floor for opportunities to make it more functional. A powder room off the kitchen, moving the laundry up from the basement and creating a main floor bedroom are all examples of solutions we have seen to reduce the reliance on stairs and allow homeowners to continue enjoying their home.

3: Take the pressure off with an extra set of hands

You’re able to still manage your home but some chores have become more daunting than you’d like to admit. Multiple services exist for just this reason and range from help shoveling the snow to bringing your fresh groceries to the door. There are options that can fit every budget to take on some of the heavy lifting that goes with with home ownership.

4: An ounce of prevention…

… Is truly worth a pound of cure. When renovating think about changes you can make now that would serve you as you age. There are some brilliant ways to create a more adaptable home for people who plan on Aging In Place. We are happy to talk about changes that would increase your property value and those that could limit the buyer pool down the road.

Please reach out below to discuss your unique situation.

6 things that have changed in Real Estate since you bought your home

6 things that have changed in Real Estate since you bought your home

Many of My clients have not bought or sold real estate in a number of years.

Here is an overview of legal, procedural, and marketing changes that have come about over the last few decades.

Agency Representation.

Prior to 1995, all real estate agents in Ontario were representing the interests of the seller of a property. This was confusing to buyers, who thought the agent helping them buy a home was working for them. Since 1995 buyers are typically represented by an agent they have “hired” to work for them and protect their best interests. In all Canadian jurisdictions, a REALTOR® is required to present you with a written explanation of how representation works at the beginning of the relationship.

The Paperwork.

The mountains of paperwork can seem daunting. Your REALTOR® will walk you through it all and give you time to have your lawyer and your family look it over, if you wish. The forms are standard, so most lawyers will be familiar with them.

Home Staging.

With all the design shows on TV these days, buyers expect every house they walk into to look perfect. In response to this, an entirely new industry was born: Home Staging. Stagers are trained to make your home as visually appealing as it can be, and to maximize flow and use of space. Staging helps potential buyers move through your home with ease, and also sets the stage for excellent photos.

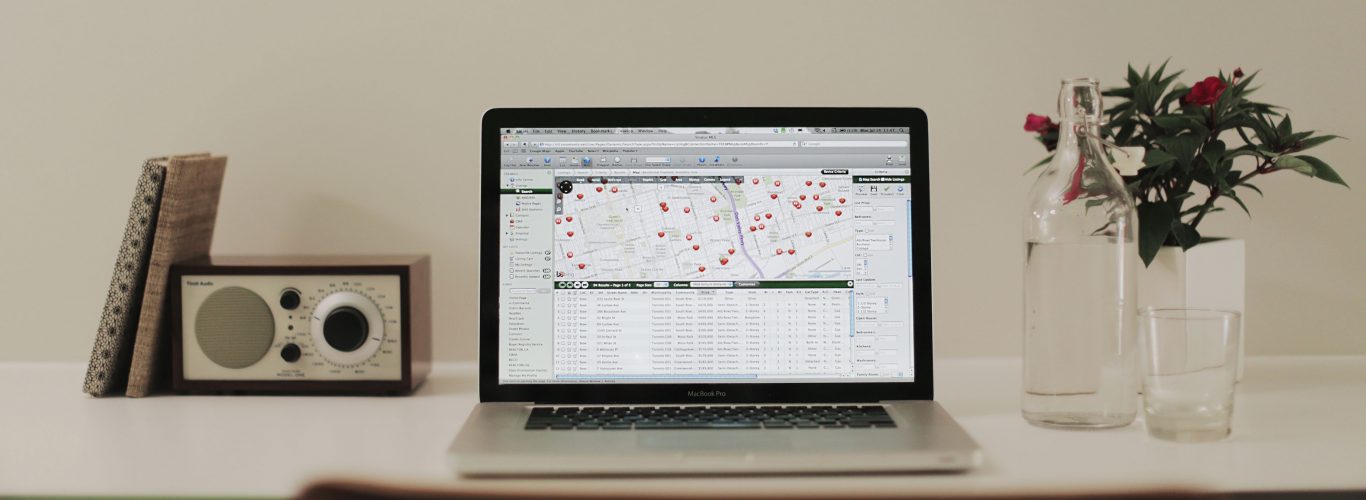

The Internet.

It was only 3 years ago that the Toronto Real Estate Board made the change to allow 20 photos per listing instead of 9. This was important, because when buyers aren’t watching design shows, they are scouring listings on the internet. Those perfectly staged photos need to stand out in a sea of listings. REALTORS® are no longer the gatekeepers to listings – the internet feeds listings to buyers faster than any agent possibly can. This has shifted the role of the REALTOR®, placing a greater emphasis on skilled negotiations, marketing and analysis.

Home Inspections.

Before they commit to buying your home, a buyer will want to have an inspection done. The inspector is trained in general construction matters, and a good home inspector is in the home for 2-3 hours, inspecting and preparing a report card on the home’s current condition for the buyers. Inspectors look for the good, the bad, and the ugly, and provide a detailed report.

A more recent change is that a home inspection will often be completed in advance of a home being listed. This “pre-list” inspection report will be provided to potential buyers to reduce the likelihood of conditional offers on a property. This is common practice in markets where there are often multiple offers on the same home.

Multiple Offers.

Multiple Offers are not a new phenomenon, but they have become a lot more common in the last few years. The likelihood that a home will receive multiple offers depends on a number of factors, including the state of the market at the time of listing, the neighborhood, the number of competing listings, the list price, and the strength and execution of the listing marketing plan.

Many sellers will choose to set an offer date to encourage multiple offers. A set offer date is typically 5 – 7 days following the list date. This approach allows for a marketing period, so the property can be exposed to a larger number of potential buyers. On the set offer date, any interested party will submit their offer for consideration. Within a set amount of time the seller will be able to consider and weigh the multiple offers and select the best fit.

A prudent REALTOR® will establish ahead of time the seller’s preferences, including closing date, what is included and excluded (for example, window coverings), and how they would like the offers to be presented. There are a number of strategies and negotiation options available when navigating multiple offers. A well-managed and transparent process garners the best results.

You may very well have more questions. Contact me and I will be happy to walk you through the process and the options.

CRA Claimable Expenses While Remaining at Home

CRA Claimable Expenses While Remaining at Home

ortunately, the Canadian government offers a range of provisions, deductions, and credits for claimable medical expenses, providing essential financial support to seniors choosing to stay in their homes. Understanding these claimable expenses can significantly alleviate the burden of healthcare costs and ensure comprehensive coverage for elderly individuals aging in place.

In this guide, we explore the spectrum of claimable medical expenses available to seniors remaining at home in Canada. From essential healthcare costs to specialized deductions and credits, this breakdown aims to empower seniors and their families with insights into maximizing the benefits provided by the government, ultimately enabling a better-managed and financially sustainable approach to healthcare.

Below you will find some specific claimable expenses we feel would apply to individuals looking to remain in their home for as long as possible. These descriptions are from Canada Revenue, you can find more information on their website.

Claimable Expenses – Outfitting Your Home

- Certificates – the amount paid to a medical practitioner for filling out and providing more information for Form T2201, Disability Tax Credit Certificate, and other certificates.

- Chair – power-operated guided chair to be used in a stairway, including installation – prescription needed.

- Bathroom aids to help a person get in or out of a bathtub or shower or to get on or off a toilet – prescription needed.

- Driveway access – reasonable amounts paid to alter the driveway of the main place of residence of a person who has a severe and prolonged mobility impairment, to ease access to a bus.

- Walking aids – the amount paid for devices designed only to help a person who has a mobility impairment – prescription needed.

- Lift or transportation equipment (power-operated) designed only to be used by a person with a disability to help them access different areas of a building, enter or leave a vehicle, or place a wheelchair on or in a vehicle – prescription needed.

Navigating healthcare expenses is a pivotal aspect of maintaining a quality lifestyle.

Claimable Expenses – Personal Hygiene and Care

- Catheters, catheter trays, tubing, or other products needed for incontinence caused by illness, injury, or affliction.

- Elastic support hose designed only to relieve swelling caused by chronic lymphedema – prescription needed.

- Hearing aids or personal assistive listening devices including repairs and batteries.

- Nurse – the amount paid for services of an authorized nurse.

Claimable Expenses – In Case of Emergency

- Respite care expenses

- Ambulance service to or from a public or licensed private hospital.

The Canadian government’s provision of claimable medical expenses offers essential support and financial relief to seniors who choose to remain in their homes as they age. Understanding the breadth of available deductions, credits, and benefits is key to optimizing healthcare coverage and managing expenses effectively. By staying informed and leveraging these provisions, seniors and their families can navigate healthcare costs with greater ease, ensuring a more comfortable and secure living environment.

This guide aims to equip seniors with the knowledge needed to identify and claim the medical expenses they are entitled to, fostering a greater sense of financial security and independence while aging at home. Remember to always discuss finances with an accounting professional.

CRA Claimable Expenses – Moving to Senior Living

CRA Claimable Expenses – Moving to Senior Living

Navigating healthcare expenses can be a daunting task, especially for seniors residing in retirement or long-term care homes in Canada. Fortunately, the Canadian government offers avenues for claiming medical expenses, providing financial relief and support to individuals in these settings. Understanding the array of medical expenses that can be claimed is crucial for optimizing available benefits and ensuring proper healthcare coverage for residents.

In this quick list, I will delve into the world of claimable medical expenses available to those living in retirement or long-term care homes in Canada. From essential healthcare costs to specific deductions and credits, this comprehensive breakdown aims to empower seniors and their families with insights into maximizing the benefits offered by the government, thereby alleviating the financial strain associated with healthcare.

Did you know that when living in a retirement home or a long-term care home whether permanently or a respite stay, you may be eligible to claim some of the care and services that are provided? At tax time, the home will provide you with a tax slip that is broken down into rent and care/services in order to make it a bit easier. For more information on what the government will allow you to claim, have a look at the full explanation here.

Below you will find some specific claimable expenses we feel would apply to individuals looking to make a move to a retirement home or long-term care home. These descriptions are from Canada Revenue, you can find more information on their website.

Claimable Expenses – Pre-Move

- Certificates – the amount paid to a medical practitioner for filling out and providing more information for Form T2201, Disability Tax Credit Certificate, and other certificates.

- Moving expenses – reasonable moving expenses (that have not been claimed as moving expenses on anyone’s return) to move a person who has a severe and prolonged mobility impairment, or who lacks normal physical development, to housing that is more accessible to the person or in which the person is more mobile or functional, to a limit of $2,000 (for residents of Ontario, the provincial limit is $3,081).

- Note-taking services used by a person with an impairment in physical or mental functions and paid to someone in the business of providing these services. A medical practitioner must certify in writing that these services are needed.

Claimable Expenses – Outfitting your new home

- Bathroom aids to help a person get in or out of a bathtub or shower or to get on or off a toilet – prescription needed.

- Hospital bed including attachments – prescription needed.

- Walking aids – the amount paid for devices designed only to help a person who has a mobility impairment – prescription needed.

- Wheelchairs and wheelchair carriers – can be claimed without any certification or prescription.

Claimable Expenses – Personal Hygiene

- Catheters, catheter trays, tubing, or other products needed for incontinence caused by illness, injury, or affliction.

- Diapers or disposable briefs for a person who is incontinent because of an illness, injury, or affliction.

- Elastic support hose designed only to relieve swelling caused by chronic lymphedema – prescription needed.

- Hearing aids or personal assistive listening devices including repairs and batteries.

- Ileostomy and colostomy pads including pouches and adhesives.

Understanding the landscape of claimable medical expenses for residents of retirement or long-term care homes in Canada is vital for ensuring comprehensive healthcare coverage and financial stability. The Canadian government extends a range of provisions, deductions, and credits to assist in offsetting medical expenses incurred by individuals in these settings. By staying informed about what can be claimed and how to navigate the system, seniors and their families can optimize available benefits, providing essential support in managing healthcare costs.

I hope this guide has shed light on the various avenues available for claiming medical expenses, empowering individuals to make informed decisions and access the support they rightfully deserve. Remember to always discuss finances with an accounting professional.

Accredited Senior Agent ASA®

Accredited Senior Agent® (ASA®) is uniquely qualified to help you take the next step.

Meet Ian Campbell, your trusted Real Estate Agent specializing in serving seniors in the Ottawa area. With over 15 years of experience in the industry and a deep understanding of the unique needs of older adults, Ian is dedicated to providing personalized guidance and support to seniors and their families.

As a senior himself and holding the prestigious ASA® (Accredited Senior Agent) designation, Ian brings firsthand insight into the challenges and concerns that seniors may face when navigating the real estate market. He understands the importance of finding a home that meets both current and future needs, whether it’s downsizing, relocating to a retirement community, or finding the perfect forever home.

Ian’s passion for helping seniors goes beyond his professional role. He is committed to making the transition to the next phase of life as smooth and stress-free as possible for his clients. With his empathy, integrity, and dedication, Ian strives to exceed his clients’ expectations and build lasting relationships based on trust and respect.

When he’s not assisting clients, Ian enjoys spending time with his family, engaging in outdoor activities, and discussing home renovations. Contact Ian Campbell today to experience personalized service and expert guidance tailored to your unique real estate needs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link